Ethereum price analysis 2020

Ethereum/ether is a local coin of the ethereum arrange which can be moved starting with one keen agreement address then onto the next where the exchange will arrive at the subsequent brilliant agreement address after being confirmed by the excavators the system given that the primary shrewd agreement address pays the diggers expenses. A few diggers can rent their registering capacity to scarcely any mining pool so that consequently they get award in type of digging expenses charged for approving exchange just as new ether coin mined therefore viewed as utilizing a proof of work agreement. Towards the start of 2020, the ethereum organize changed from a proof of work to a proof of stake accord in this manner permitting stakers to have the option to stake their ether to few staking pool, for example, https://ethstaking.io/and https://www.rocketpool.net/along these lines consequently you acquire prize of up to 6% per anum or above in type of new coin stamped and exchange expenses charged for approving exchanges on the ethereum arrange. Designers can likewise have the option to make diverse dapps on the ethereum organize where they will be paying charges for facilitating their dapps over yonder. Similar engineers can likewise make the tokens of their dapps utilizing their shrewd agreement address on ethereum arrange so that it turns into the utility coin of the network individuals from their dapps to such an extent that at whatever point their locale part is utilizing those dapps,then they will be remunerated with those tokens which they can move to a few dex trades and convert them back to ethereum.In request for them to move those tokens from one savvy contract address to another,the clients of those dapps should pay a gas charges as far as ether so that the validators running the ethereum system can start the exchange on the ethereum network.In late 2015, one ether was going for around $0.4. Towards the start of 2016, the value figured out how to go as high as above $1 after which it figured out how to go above $10 again as 2017 was beginning. As 2017 was winding up,the cost had figured out how to go as high as above $700. As 2018 was starting,the value figured out how to go as high as $1300 subsequently benefitting those early excavators who were all the while holding their ether at that point. In 2018,the cost went as low as $80. As of now, one ether is exchanging at around $230. The expansion in cost was because of an increment in the quantity of diggers renting their processing capacity to approve exchange and mint new ether coin to the ethereum arrange since at that point, the ethereum organize had not actualized dapps expanding on their system. The decline in cost again was because of a few excavators dumping their earned ether to a few trades with the goal that they can benefit from the unexpected increment in its cost. Consequently, since ethereum arrange had the option to change from confirmation of work to evidence of stake accord just as to execute working of dapps on its system, we can subsequently clarify its future value expectation dependent on dapps based on its systems as follows;

Dapps based on ethereum organize

When ethereum was propelled ,it was utilizing verification of work agreement where diggers could rent their processing capacity to a few mining pool to utilize it to approve any exchange occurring on the ethereum organize in this manner consequently they get award in type of excavators expenses charged and new coin printed . In 2019, another proposition was made by Vitalik to change the system to a proof of stake accord since it is less expensive when contrasted with evidence of work agreement. As of now, ethereurm organize utilizes verification of stake accord which was actualized towards the start of 2020.Before confirmation of stake agreement was executed, ethereum arrange had as of now at first executed the structure of dapps on its systems a few years back. Despite the fact that ethereum is a previously settled system, we will at present clarify its value investigation dependent on dapps based on its system. Therefore,we can say that as more designers are joining the ethereum system to manufacture their dapps over there,the utility capacity of ether coin will increment because of increment sought after by the network individuals from those dapp

s worked over yonder. This will result to an expansion in its cost. Then again, if the designers previously expanding on the ethereum organize begin moving to other system because of adaptability issues, for example, high exchange expenses charged, at that point the interest for ether coin will decay in this manner making its utility capacity likewise decrease. Here are a portion of the dapps based on ethereum arrange which are key determinants to its future cost;

a. Compound.finance

This is an enthusiasm bearing dapps based on the ethereum arrange by means of the metamask which is savvy contract ethereum wallet. At compound.finance, clients can procure enthusiasm of over 10% the entire year after locking their upheld ether token over yonder, for example, Dai and ethereum for a given timeframe. Therefore,we can say that as more clients keep on opening their ether on the compound.finance dapp, at that point the ether coin will begin turning out to be wastefulness on its system along these lines making its interest additionally increment . This expansion sought after will thusly result to an expansion in the ether coin. Then again, if the clients who had been locking their ether coin on the compound.finance begin to open them because of a decrease on premium earned, at that point the measure of ether will begin turning out to be in surplus on its system therefore making its interest additionally decay. In light of this,its cost will likewise begin to decay

B. Uptrennd

Uptrennd is a distributing internet based life dapp based on ethereum organize that compensates all sort of makers just as clients with 1UP token for sharing their work just as for getting connected on the stage. Currently,uptrennd has more than 60,000 enlisted clients. In this manner, we can say that as more clients keep on joining the uptrennd stage, at that point the utility capacity of ether coin will likewise keep on expanding since uptrennd clients will buy ether coin with the goal that they can utilize it to buy 1up coin in a few dex trade after which they will store those 1up coin to their uptrennd account so they can utilize them to update their level so as to build their acquiring on the stage or to utilize them to publicize their business on uptrennd stage. Then again, in the event that the prize for makers and clients on uptrennd stage decay ,at that point uptrennd clients will search for another stage which will result to a decrease in the utility capacity of ether coin because of a lessening in its interest. This will result to a reduction on ether cost.

C. IDEX

Idex is a decentralized trade based on ethereum arrange that permits clients to have the option to purchase various tokens made on the ethereum coordinate with their ether balance. Clients of various dapps made on the ethereum system can likewise have the option to sell the tokens of those dapps on the idex trade and get their ether over yonder. So as to login into your idex account, you have to utilize your ethereum private key. There are hundred of thousands utilizing idex to trade their token back to ether. Therefore,we can say that an expansion in the quantity of clients on the idex stage will result to an expansion in the interest of ether in this manner making its cost additionally increment. Then again, if numerous dapps move to different systems due to ethereum versatility issues, the idex clients will likewise decay in this manner declining the interest for ether coin. This will additionally results to a decrease in cost of the ether coin.

Besides, we can clarify the 2021 value forecast for ether coin utilizing the bullish and bearish economic situation as follows;

Bullish ethereum dependent on dapps based on its system

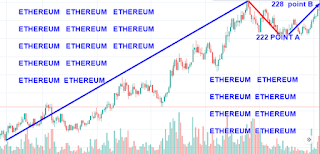

In a bullish economic situation, the ethereum market will be moving in an upwards course. In mid 2015, one ethereum was going for around $0.4. After three years, the cost had figured out how to go as high as $1300 after which it dropped again to around $250 where it has figured out how to exchange at around that cost. Right now, one ethereum is exchanging at around $230. The expansion in cost was because of an increment in the quantity of diggers to share their processing capacity to be utilized to make sure about the ethereum arrange just as to approve exchange occurring on the ethereum organize since at that point ,ethereum arrange had not yet actualized the formation of dapps on its system. The lessening in cost again was because of the dumping of ethereum by a few excavators so they can benefit from its significant expense. At present, there are numerous dapps based on ethereum organize . This will empower us to dissect its 2021 value forecast . We can in this manner state that as more dapps are being based on the ethereum organize, the utility capacity of ether will likewise increment because of an expansion in its interest since those dapps will likewise need to utilize ether coin to pay for exchange cost of their dapps just as for moving their made and gave tokens starting with one keen agreement address then onto the next. In one year time from now, there is plausibility of ether coin to go above $300 if more dapps will keep on being made on the ethereum organize. Here is the bullish market for ethereum;

The above is the ethereum advertise as far as USDT. Two focuses are being shown. There is point An and point B. Before point A, the ethereum market can be believed to have been inclining upwards right to above $228. This expansion in cost has been because of the increment in the quantity of dapps being made on the ethereum arrange. The clients of those dapps in the wake of changing over their earned tokens of those dapps to ethereum, they at that point choose to dump ethereum in a few trades so they can get their fiat cash. This made an overflow of ethereum therefore making its cost marginally drop downwards to point An at around $222. More engineers at that point join the ethereum system to build up their dapps over yonder where they buy the ethereum in a few trades so it can assist them with creating and issue the token of their da

Ethereum/ether is a local coin of the ethereum arrange which can be moved starting with one keen agreement address then onto the next where the exchange will arrive at the subsequent brilliant agreement address after being confirmed by the excavators the system given that the primary shrewd agreement address pays the diggers expenses. A few diggers can rent their registering capacity to scarcely any mining pool so that consequently they get award in type of digging expenses charged for approving exchange just as new ether coin mined therefore viewed as utilizing a proof of work agreement. Towards the start of 2020, the ethereum organize changed from a proof of work to a proof of stake accord in this manner permitting stakers to have the option to stake their ether to few staking pool, for example, https://ethstaking.io/and https://www.rocketpool.net/along these lines consequently you acquire prize of up to 6% per anum or above in type of new coin stamped and exchange expenses charged for approving exchanges on the ethereum arrange. Designers can likewise have the option to make diverse dapps on the ethereum organize where they will be paying charges for facilitating their dapps over yonder. Similar engineers can likewise make the tokens of their dapps utilizing their shrewd agreement address on ethereum arrange so that it turns into the utility coin of the network individuals from their dapps to such an extent that at whatever point their locale part is utilizing those dapps,then they will be remunerated with those tokens which they can move to a few dex trades and convert them back to ethereum.In request for them to move those tokens from one savvy contract address to another,the clients of those dapps should pay a gas charges as far as ether so that the validators running the ethereum system can start the exchange on the ethereum network.In late 2015, one ether was going for around $0.4. Towards the start of 2016, the value figured out how to go as high as above $1 after which it figured out how to go above $10 again as 2017 was beginning. As 2017 was winding up,the cost had figured out how to go as high as above $700. As 2018 was starting,the value figured out how to go as high as $1300 subsequently benefitting those early excavators who were all the while holding their ether at that point. In 2018,the cost went as low as $80. As of now, one ether is exchanging at around $230. The expansion in cost was because of an increment in the quantity of diggers renting their processing capacity to approve exchange and mint new ether coin to the ethereum arrange since at that point, the ethereum organize had not actualized dapps expanding on their system. The decline in cost again was because of a few excavators dumping their earned ether to a few trades with the goal that they can benefit from the unexpected increment in its cost. Consequently, since ethereum arrange had the option to change from confirmation of work to evidence of stake accord just as to execute working of dapps on its system, we can subsequently clarify its future value expectation dependent on dapps based on its systems as follows;

Dapps based on ethereum organize

When ethereum was propelled ,it was utilizing verification of work agreement where diggers could rent their processing capacity to a few mining pool to utilize it to approve any exchange occurring on the ethereum organize in this manner consequently they get award in type of excavators expenses charged and new coin printed . In 2019, another proposition was made by Vitalik to change the system to a proof of stake accord since it is less expensive when contrasted with evidence of work agreement. As of now, ethereurm organize utilizes verification of stake accord which was actualized towards the start of 2020.Before confirmation of stake agreement was executed, ethereum arrange had as of now at first executed the structure of dapps on its systems a few years back. Despite the fact that ethereum is a previously settled system, we will at present clarify its value investigation dependent on dapps based on its system. Therefore,we can say that as more designers are joining the ethereum system to manufacture their dapps over there,the utility capacity of ether coin will increment because of increment sought after by the network individuals from those dapp

s worked over yonder. This will result to an expansion in its cost. Then again, if the designers previously expanding on the ethereum organize begin moving to other system because of adaptability issues, for example, high exchange expenses charged, at that point the interest for ether coin will decay in this manner making its utility capacity likewise decrease. Here are a portion of the dapps based on ethereum arrange which are key determinants to its future cost;

a. Compound.finance

This is an enthusiasm bearing dapps based on the ethereum arrange by means of the metamask which is savvy contract ethereum wallet. At compound.finance, clients can procure enthusiasm of over 10% the entire year after locking their upheld ether token over yonder, for example, Dai and ethereum for a given timeframe. Therefore,we can say that as more clients keep on opening their ether on the compound.finance dapp, at that point the ether coin will begin turning out to be wastefulness on its system along these lines making its interest additionally increment . This expansion sought after will thusly result to an expansion in the ether coin. Then again, if the clients who had been locking their ether coin on the compound.finance begin to open them because of a decrease on premium earned, at that point the measure of ether will begin turning out to be in surplus on its system therefore making its interest additionally decay. In light of this,its cost will likewise begin to decay

B. Uptrennd

Uptrennd is a distributing internet based life dapp based on ethereum organize that compensates all sort of makers just as clients with 1UP token for sharing their work just as for getting connected on the stage. Currently,uptrennd has more than 60,000 enlisted clients. In this manner, we can say that as more clients keep on joining the uptrennd stage, at that point the utility capacity of ether coin will likewise keep on expanding since uptrennd clients will buy ether coin with the goal that they can utilize it to buy 1up coin in a few dex trade after which they will store those 1up coin to their uptrennd account so they can utilize them to update their level so as to build their acquiring on the stage or to utilize them to publicize their business on uptrennd stage. Then again, in the event that the prize for makers and clients on uptrennd stage decay ,at that point uptrennd clients will search for another stage which will result to a decrease in the utility capacity of ether coin because of a lessening in its interest. This will result to a reduction on ether cost.

C. IDEX

Idex is a decentralized trade based on ethereum arrange that permits clients to have the option to purchase various tokens made on the ethereum coordinate with their ether balance. Clients of various dapps made on the ethereum system can likewise have the option to sell the tokens of those dapps on the idex trade and get their ether over yonder. So as to login into your idex account, you have to utilize your ethereum private key. There are hundred of thousands utilizing idex to trade their token back to ether. Therefore,we can say that an expansion in the quantity of clients on the idex stage will result to an expansion in the interest of ether in this manner making its cost additionally increment. Then again, if numerous dapps move to different systems due to ethereum versatility issues, the idex clients will likewise decay in this manner declining the interest for ether coin. This will additionally results to a decrease in cost of the ether coin.

Besides, we can clarify the 2021 value forecast for ether coin utilizing the bullish and bearish economic situation as follows;

Bullish ethereum dependent on dapps based on its system

In a bullish economic situation, the ethereum market will be moving in an upwards course. In mid 2015, one ethereum was going for around $0.4. After three years, the cost had figured out how to go as high as $1300 after which it dropped again to around $250 where it has figured out how to exchange at around that cost. Right now, one ethereum is exchanging at around $230. The expansion in cost was because of an increment in the quantity of diggers to share their processing capacity to be utilized to make sure about the ethereum arrange just as to approve exchange occurring on the ethereum organize since at that point ,ethereum arrange had not yet actualized the formation of dapps on its system. The lessening in cost again was because of the dumping of ethereum by a few excavators so they can benefit from its significant expense. At present, there are numerous dapps based on ethereum organize . This will empower us to dissect its 2021 value forecast . We can in this manner state that as more dapps are being based on the ethereum organize, the utility capacity of ether will likewise increment because of an expansion in its interest since those dapps will likewise need to utilize ether coin to pay for exchange cost of their dapps just as for moving their made and gave tokens starting with one keen agreement address then onto the next. In one year time from now, there is plausibility of ether coin to go above $300 if more dapps will keep on being made on the ethereum organize. Here is the bullish market for ethereum;

The above is the ethereum advertise as far as USDT. Two focuses are being shown. There is point An and point B. Before point A, the ethereum market can be believed to have been inclining upwards right to above $228. This expansion in cost has been because of the increment in the quantity of dapps being made on the ethereum arrange. The clients of those dapps in the wake of changing over their earned tokens of those dapps to ethereum, they at that point choose to dump ethereum in a few trades so they can get their fiat cash. This made an overflow of ethereum therefore making its cost marginally drop downwards to point An at around $222. More engineers at that point join the ethereum system to build up their dapps over yonder where they buy the ethereum in a few trades so it can assist them with creating and issue the token of their da

0 Comments